In today’s fast-paced world, change is the only constant. Every aspect of our lives has been upgraded and evolved, from the technology we use to the ways we manage our finances.

This shift isn't merely a trend; it's essential to keep up with the ever-changing demands of modern life.

Consider our journey with mobile phones. Not too long ago, we relied on basic Nokia phones that were primarily used for calling and texting. These phones were durable and served their purpose well. As technology advanced, so did our expectations. We transitioned from basic models to smartphones, which opened up a world of possibilities.

Consider our journey with mobile phones. Not too long ago, we relied on basic Nokia phones that were primarily used for calling and texting. These phones were durable and served their purpose well. As technology advanced, so did our expectations. We transitioned from basic models to smartphones, which opened up a world of possibilities.

With each upgrade—from the iPhone 6 to the iPhone 8, and now to the latest iPhone 12, 14, and 15 Pro—we’ve embraced new features, better performance, and more convenience. Every 3-4 years, we find ourselves upgrading to the latest model, ensuring that we’re always equipped with the best tools to stay connected, informed, and entertained.

Our evolution doesn’t stop at phones. Think about how our relationship with television has changed. We started with black and white TVs, where the idea of color seemed like a distant dream. As technology evolved, our viewing experience improved as well.

We moved from color TVs to LCDs, then to LEDs, and now to internet TVs that offer a seamless connection to the digital world. Today, we even have curved screens and smart TVs with advanced features, bringing a theater-like experience right into our living rooms.

Similarly, our home appliances have seen remarkable upgrades. Take refrigerators, for example. The basic single-door fridge was once a luxury in many homes. As our needs grew, so did the technology. We upgraded to double-door fridges, and now, we have 4-door models with advanced features like smart cooling, touch screens, and even internet connectivity. Our desire for more convenience, efficiency, and style in our homes is reflected in these changes.

Our shopping habits have also transformed dramatically. We’ve shifted from traditional brick-and-mortar stores to online shopping, which offers us unparalleled convenience. The way we shop has been revolutionized by the ability to browse, compare, and purchase products from the comfort of our homes.

We moved from color TVs to LCDs, then to LEDs, and now to internet TVs that offer a seamless connection to the digital world. Today, we even have curved screens and smart TVs with advanced features, bringing a theater-like experience right into our living rooms.

Similarly, our home appliances have seen remarkable upgrades. Take refrigerators, for example. The basic single-door fridge was once a luxury in many homes. As our needs grew, so did the technology. We upgraded to double-door fridges, and now, we have 4-door models with advanced features like smart cooling, touch screens, and even internet connectivity. Our desire for more convenience, efficiency, and style in our homes is reflected in these changes.

Our shopping habits have also transformed dramatically. We’ve shifted from traditional brick-and-mortar stores to online shopping, which offers us unparalleled convenience. The way we shop has been revolutionized by the ability to browse, compare, and purchase products from the comfort of our homes.

Now with just a few clicks, we can have our desired items delivered right to our doorstep within a few days.

Fashion trends are another area where we constantly adapt and upgrade. We follow the latest styles, changing our wardrobes to keep up with what’s in vogue. This constant evolution in our clothing choices reflects our desire to stay relevant and express ourselves in new and exciting ways.

Even our methods of payment have evolved. There was a time when cash ruled.

But as the world moved toward digitalization, we embraced new ways to pay. From net banking to debit and credit cards, and now to QR codes and mobile payments, each step has brought us closer to a cashless society. Not only do these changes offer convenience, but they also improve security, making transactions quicker and simpler.

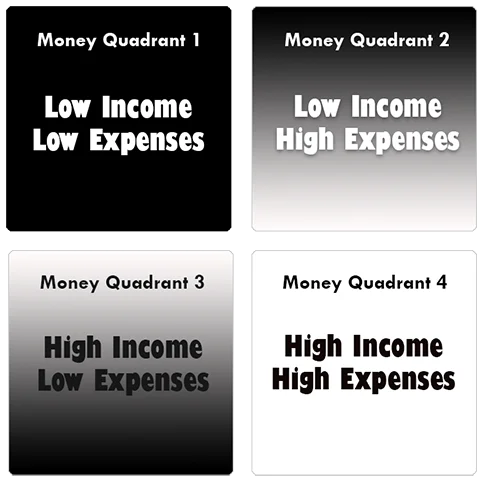

Investment styles have not been left behind in this wave of change. Traditionally, we relied on NSCs (National Savings Certificates), fixed deposits, and recurring deposits to grow our wealth. These were considered safe and reliable options. However, as the financial landscape evolved, so did our investment strategies. We moved toward systematic investment plans (SIPs) and the stock market, recognizing the potential for higher returns. This shift reflects our growing understanding of finance and our willingness to take calculated risks for greater rewards.

As time has passed, we’ve adapted in every aspect of our lives. Now, it’s time to upgrade your record-keeping methods. Just as we’ve upgraded our gadgets, appliances, shopping habits, and financial strategies, it’s crucial to upgrade the way we manage and track our finances. Traditional methods of record-keeping, like jotting down expenses in a physical notebook, are no longer sufficient. They are susceptible to errors, challenging to organize, and lack the adaptability needed in today’s fast-paced world.

Switching to a digital record-keeping solution like Tracker Guru ensures that your financial records are precise, secure, and readily accessible.

This contemporary method enables you to handle your income, investments, expenses, and more with just a few clicks. Bid farewell to searching through bunch of paper/files or remembering where you noted that detail.

Everything is organized, searchable, and available at your fingertips.

Our family and friends largely shape our behaviors and attitudes toward money.

We often inherit their approaches to managing finances, but as the world evolves, so should our mindset. Think wealth, not just money. It’s about building a secure and prosperous future, not just getting by.

Adopt the mindset of those who have mastered the art of wealth management. Think and act like a Marwadi—a community known for its financial acumen and business savvy. They grasp the value of money not only in numerical terms but also in terms of opportunity and growth. They invest wisely, manage their finances meticulously, and always look for ways to improve.

In conclusion, as we continue to upgrade every aspect of our lives, it’s time to upgrade how we manage our financial records. Embrace the change, adapt to modern methods, and take control of your financial future with Tracker Guru. Your financial management should be digital, as the future is.